Budget approved amid reorganisation funding fears

Chelmsford City Council’s budget has been approved by its Full Council for the coming financial year, but uncertainty has increased for 2026/27 over the unknown upfront costs of Local Government Reorganisation.

Financial impact of council mergers unknown

Although a balanced budget has been passed for 2025/26, the forthcoming financial impact of abolishing Chelmsford City Council and merging into a bigger unitary authority has not been costed. Currently the Government expects the financial burden of this changeover to be borne by the councils themselves, which the budget report says ‘could be several million pounds’.

Earlier this month, Greater Essex was accepted onto the Government’s Devolution Priority Programme following a bid by Essex, Southend and Thurrock councils. This means over the next two to three years, the 15 existing Essex councils must merge into a much smaller number of unitary councils that deliver all services to residents. At the same time, Government funding during this transition period could also become considerably worse. A new system the Government intends to use to work out how councils are funded is unfavourable to Chelmsford, which is likely to mean the amount the city council receives in government grants and business rates will be further reduced.

Support down and costs up

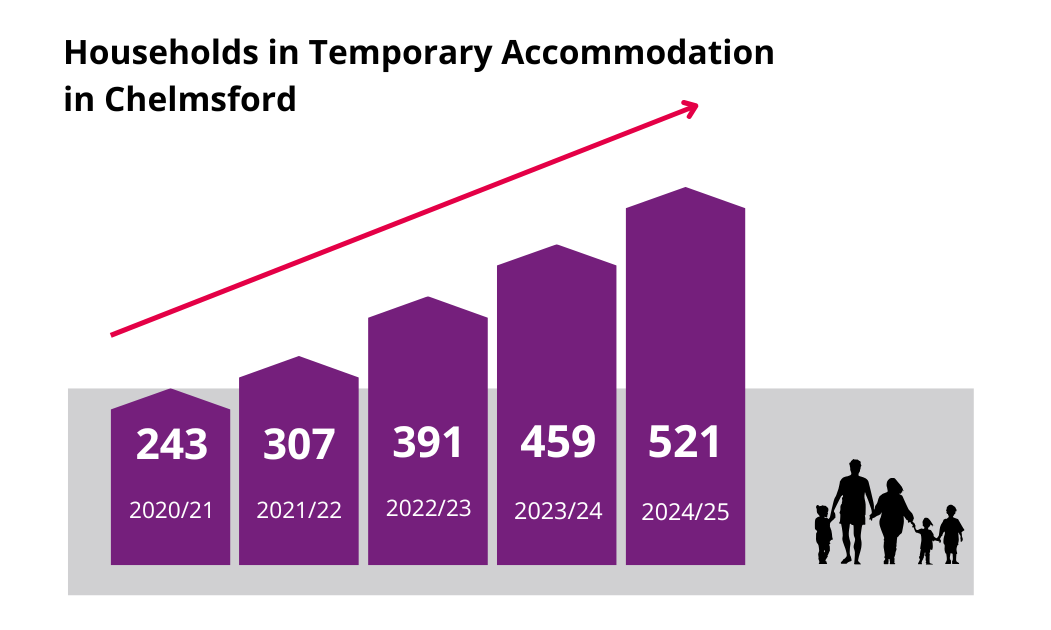

The city council’s costs have risen dramatically over the last three years - some trebling in amount. However, the council’s income hasn’t kept pace. Funding from central Government has been falling in real terms since 2010, and the 10% share of the council tax paid by Chelmsford residents can’t match inflation and increased demand for council services, like looking after more than 500 homeless households.

These pressures led to a deficit being forecast in late 2024 of £4m for 2025/26. Since then, other Government decisions, such as the rise in employers’ National Insurance Contributions and another increase in the National Living Wage, have led to extra, unfunded costs for the council.

Rising homelessness costs

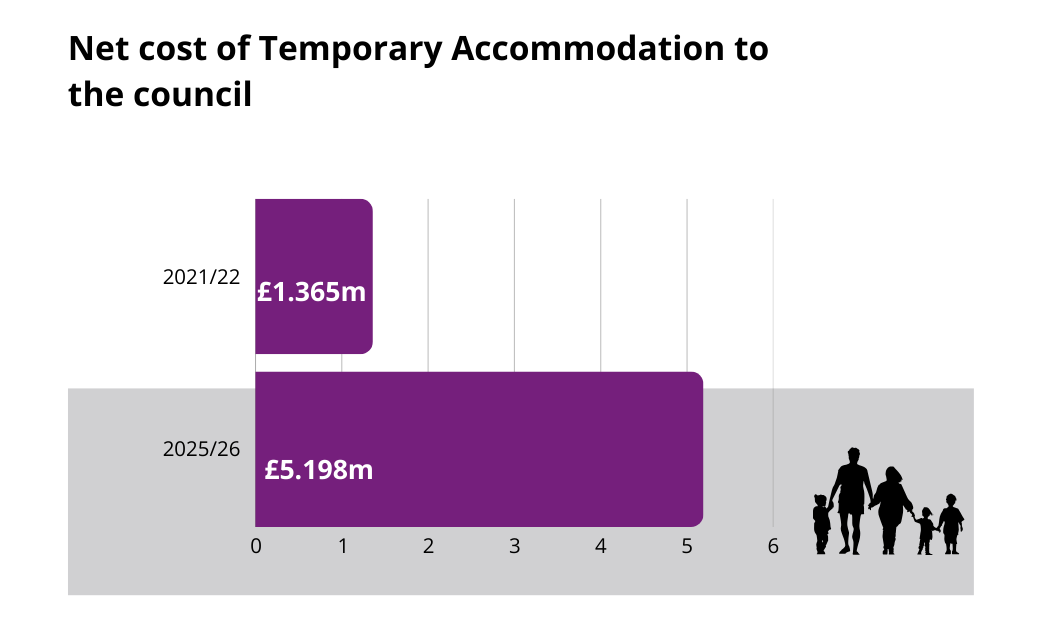

A key pressure is the council’s rapidly growing spend on homelessness – mainly on temporary accommodation (TA). The net cost of TA to the council in 2025/26 will be £5.2m. In 2020/21, council net cost was just £1.4m. This huge increase of 271% in just five years reduces the council’s ability to finance other services to residents.

The city council, with housing associations, has plans to build new affordable homes in the next couple of years. However, with numbers rising, this will only help slow the increase of homeless Chelmsford families needing TA in future years. With each new case of homelessness costing the council around £13k per year on average, this extra demand for an essential, but expensive, service is helping to create an unsustainable shortfall in council finances.

Investing in the community via capital programme

Every year, the council has a programme of works needed to properly maintain its assets and estate. Riverside Leisure Centre will undergo essential replacement works for its roof and cooling system next year, along with other maintenance and improvement at Chelmsford Sport and Athletics Centre.

As part of the capital programme, extra funding is also allocated for a new six-pitch sports and recreation ground at Beaulieu Park, paid for by a contribution from the developer. The council’s contribution to deliver the project comes from other s106 planning obligations specifically made for sports provision in this area, at no additional cost to the council. The council will manage and maintain the new facility once the project has been completed.

Fees and charges increase to protect services

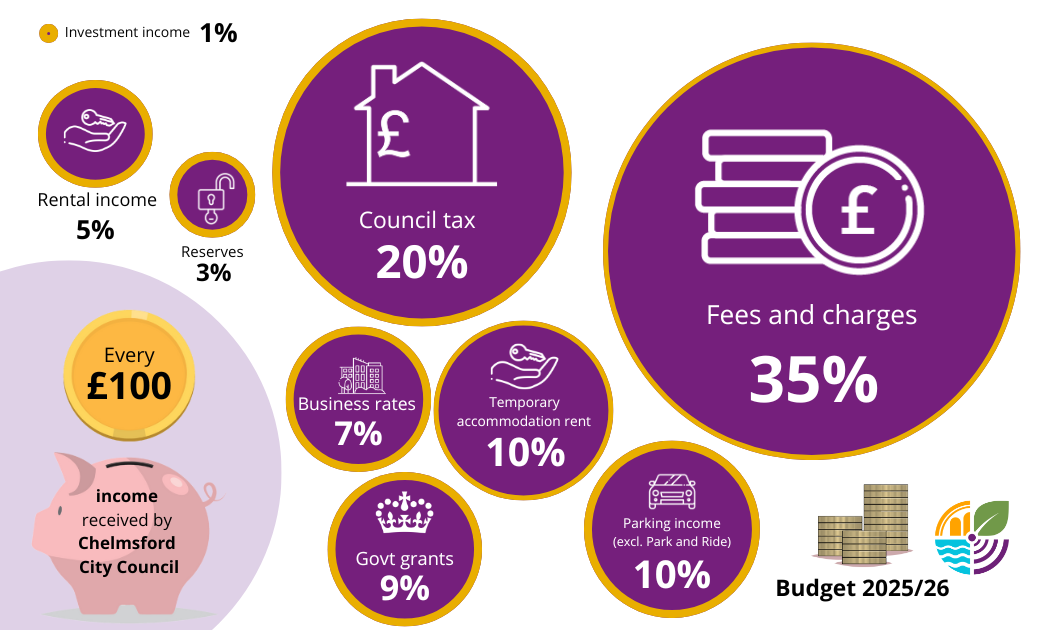

Without more government support, tough decisions have been needed for the coming financial year to both close the budget gap and avoid permanent cuts to council services. In December, Chelmsford City Council reluctantly decided to join most other English local authorities in switching to paid garden waste collections, and local charges in general have become increasingly important to balance the books – a trend seen across the country. In 2025/26, around 45% of the council’s income will be from fees and charges and parking charges, with a smaller proportion from council tax and 9% from Government grants.

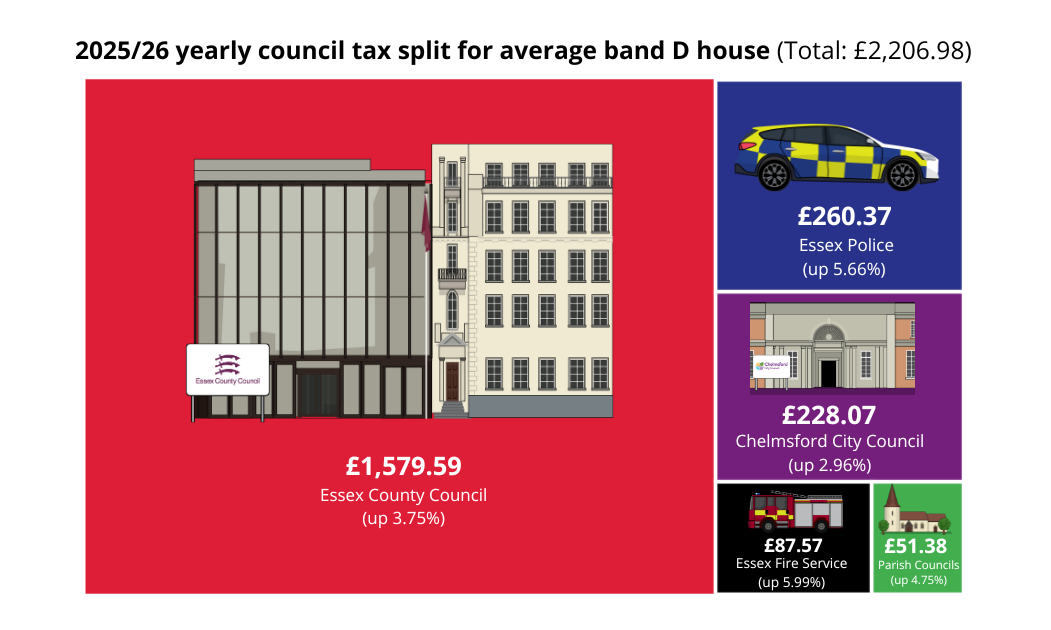

City council’s share of council tax set

Chelmsford City Council keeps 10% of the council tax residents pay, with the majority (72%) going to Essex County Council. The city council is raising its share of council tax by 2.96% for the coming year, which means an average band D property will pay a total of £228.07 in council tax to the city council - an increase of £6.55 on last year, which works out at an extra 13p a week.

Councils and other organisations receiving council tax set their own increases, which apply to their individual share. The city council is raising its council tax precept by the lowest amount to help deliver its services in 2025/26.

Councillor Chris Davidson, Cabinet Member for Finance, says while important, council tax only pays for some of the city council’s services.

““Council tax is a significant and valued part of our funding, but it’s only paying for just over a fifth of the services we deliver. That doesn’t even cover all those we legally have to provide like black bin collection, street cleaning and helping homeless families.

Cllr Chris Davidson, Cabinet Member for Finance

“If we didn’t introduce charges for brown bin collection, other services that aren’t legally required like our swimming pools, our leisure centres or our museum could have to close as there wouldn’t be enough money to pay for them. With government support expected to reduce even further over the next few years and the cost of reorganisation unknown, the choice is stark: charge, as most other councils already do, or cut services.

“By 2028, Chelmsford City Council will no longer exist, but we must do all we can to protect the services and venues Chelmsford residents value and rely on and give whatever new council we’re part of the best possible start.”

Impact of reorganisation to be discussed

The immediate financial impacts associated with Local Government Reorganisation are unclear. Over the coming months, the council will develop a plan to protect services for the remainder of Chelmsford City Council’s existence and leave the new unitary council a good starting position for the future.

If you’d like to know more about how Chelmsford City Council will be changing, or news about our budgets, sign up to our weekly newsletter to get the latest updates.